TurboTax Premier 2022 Fed + E-file & State Digital Download

Table of Content

- TurboTax Home and Business 2020 - Physical Disc.

- How do I download TurboTax State for Windows?

- Turbotax HOME & BUSINESS Federal & State Returns Personal & Self Employed

- Turbotax Home And Business 2020 - Windows Edition - Bing.

- Turbotax Home And Business - DownloadKeeper.

- Why use TurboTax Home & Business?

- TURBOTAX ONLINE GUARANTEES

Over the past 5 years, more than 24M returns have been electronically filed with TurboTax based on CRA NETFILE reporting. The quick and smart way to handle your tax return. TurboTax Deluxe maximizes deductions for mortgage interest, donations, education, and more.

More than 5 million Canadians use our software to get their maximum tax refund, every single year. TurboTax can help find you any new tax deductions and credits personalized to you and your unique situation. We’ll find every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed. Guides you through common life changes, big or small, and finds any new tax deductions and credits you may qualify for.

TurboTax Home and Business 2020 - Physical Disc.

Then, easily track your tax return on your phone with our TurboTax mobile app to see when your refund will hit your bank account. See the instructions in our FAQ regarding how to access your previous years' tax returns filed with Turbo Tax. Once you click on download/print return , you can save it and/or print it. All features, services, support, prices, offers, terms and conditions are subject to change without notice.

If you sold stock, easily determine your correct basis for shares purchased--even at different times or different prices. Perfect for multiple sources of income, including independent contractors, freelance workers (1099-MISCs & NECs) and sales from goods and services. Qualifying purchases could enjoy No Interest if paid in full in 6 months on purchases of $99 or more. Other offers may also be available.

How do I download TurboTax State for Windows?

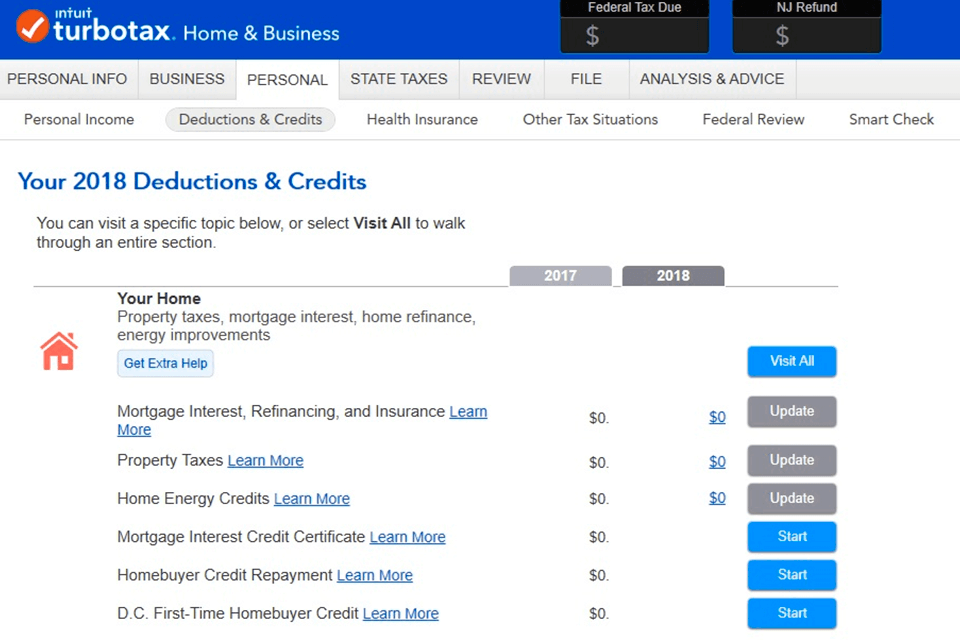

If you pay a penalty or interest due to a TurboTax calculation error, we will reimburse the penalty and interest. Does not include calculation errors due to errors in CRA tables. TurboTax Home & Business includes an expert business interview that asks you straightforward questions to help you uncover every credit and deduction you deserve. We'll ask you questions specific to your industry and find deductions personalized to your line of work, helping you uncover tax breaks you otherwise may have missed.

TurboTax runs through thousands of error checks and double-checks your tax returns before you file so you can be confident nothing gets missed. Searches for more than 350 tax deductions and credits to get you the biggest tax refund—guaranteed. If not 100% satisfied, return within 60 days to Intuit Canada with a dated receipt for a full refund of purchase price. This guarantee does not apply to TurboTax Free. Claims are based on aggregated sales data for all NETFILE tax year 2021 TurboTax products. TurboTax Home & Business is for people whose business income needs to be reported on their personal tax return.

Turbotax HOME & BUSINESS Federal & State Returns Personal & Self Employed

If you or your children attended college or trade school, get education tax credits and deductions (1098-E, 1098-T) for tuition, books, and student loan interest. Your biggest investment might also be your biggest tax break—mortgage interest, property taxes, and more. Upload a picture or PDF of your W-2 or 1099-NEC to import your data securely into the right forms. Spots overlooked tax deductions for your industry, so you don't miss any write-offs. "Membership is required to complete an in-club or curbside pickup purchase at Sam's Club."

Our Full Service Guarantee means your tax expert will find every dollar you deserve. Your expert will only sign and file your return if they know it's 100% correct and you are getting your best outcome possible. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. See Terms of Service for details. If you get a larger refund or smaller tax due from another tax preparation method, we'll refund the amount paid for our software. TurboTax Free customers are entitled to a payment of $9.99.

E-file your federal and state tax return with direct deposit to get your fastest tax refund possible. Our calculations are 100% accurate so your tax return will be done right, guaranteed, or we’ll pay you any IRS penalties. When you use desktop software, there is an additional fee to e-file a state return. You can avoid that fee if you print, sign and mail the state return.

Discover Meijer's amazing finds at low prices. Store pickup & delivery options available for top brands in foods, fashion, electronics, and 40+ departments. The Microsoft Office system has evolved from a suite of personal productivity products to a more comprehensive and integrated system.

Every personal TurboTax return is backed by our Audit Support Guarantee for free one-on-one audit guidance from a trained tax professional. TurboTax can help find you any new tax deductions and credits. TurboTax finds every tax deduction and credit you qualify for to boost your tax refund. Finish your tax return at one time or do a little at a time and pick up right where you left off.

Does not include GST/HST and other non-income tax audits and reviews unless the issues are ancillary to the income tax review itself. Includes field audits through the restricted examination of books, but does not include the "detailed financial audit". Get a comprehensive review of your online tax return before you file so you can be confident nothing gets missed. TurboTax calculations are 100% accurate on your tax return, or TurboTax will pay any IRS penalties. Once you complete your federal taxes, transfer your information over to your state return . Delivery times may vary, especially during peak periods.

The state e-file fee is $19.99 and increases in March. A simple tax return is one that's filed using IRS Form 1040 only, without having to attach any forms or schedules. Only certain taxpayers are eligible. If you have a simple tax return, you can file with TurboTax Free Edition, TurboTax Live Assisted Basic, or TurboTax Live Full Service Basic. Free filing is only available in certain products.

If your business is incorporated, you need to prepare a personal return for yourself and a separate corporate return for your business. TurboTax Home & Business is a great fit for your personal return and for your corporate return, check out incorporated business edition, TurboTax Business Incorporated. TurboTax does not store online any returns completed using the desktop editions. Interest will be charged to your account from the purchase date if the balance is not paid in full within 6 months. Minimum monthly payments are required. Internet connection and acceptance of product update is required to access Audit Defence.

Expecting a 1099-K for the first time? Guides you through deducting points, appraisal fees, and more from your refinance.

Comments

Post a Comment